Cavalry SPV I LLC: Understanding Your Opponent and Your Rights

You’ve received a lawsuit from Cavalry SPV I LLC. This is serious, but understanding your rights and options can significantly improve your chances of a positive outcome. Cavalry SPV I LLC is a debt buyer—they purchase debts, often at a steep discount, and then attempt to collect the full amount. While this can feel overwhelming, remember you’re not alone and legal protections exist to safeguard your interests. This guide provides actionable steps to navigate this situation. Did you know that many debt buyers operate with flawed procedures leading to potentially invalid claims?

Key Takeaways: Three Pivotal Points for Success

- Verify the Debt: Before reacting, meticulously verify the debt's legitimacy. Does Cavalry SPV I LLC possess the necessary evidence to prove you owe the money? This is crucial before negotiating.

- Act Promptly: Ignoring a lawsuit is a significant mistake. Promptly respond to the court and communicate with Cavalry SPV I LLC to avoid default judgments.

- Know Your Rights: The Fair Debt Collection Practices Act (FDCPA) protects you from abusive debt collection tactics. Understanding and leveraging your rights under the FDCPA is critical.

Understanding the Fair Debt Collection Practices Act (FDCPA)

The FDCPA (Fair Debt Collection Practices Act) is a federal law designed to protect consumers from abusive debt collection practices. It limits how debt collectors, including Cavalry SPV I LLC, can contact you and what they can do to collect the debt. For example, they cannot harass you with repeated calls at odd hours or make false threats. Understanding your rights under the FDCPA provides a strong foundation for handling your case effectively. Familiarize yourself with its key provisions.

Rhetorical Question: Are you aware of your rights under the FDCPA and how to use them to your advantage?

A Step-by-Step Action Plan: Taking Control of Your Lawsuit

This section provides a clear, actionable plan to address your Cavalry SPV I LLC lawsuit. Remember, each step is critical for protecting your rights and achieving the best possible outcome.

Verify the Debt (Accuracy Check): Thoroughly examine all documents provided by Cavalry SPV I LLC. Does the information accurately reflect your debt? Is the amount correct? Are there any inconsistencies or missing information? Request validation of the debt in writing—this is your right under the FDCPA. A surprising number of lawsuits are based on inaccurate or outdated information.

Respond to the Lawsuit (Formal Response): Ignoring a lawsuit will almost certainly result in a default judgment against you. Promptly respond to the court within the stipulated timeframe. An "Answer" is your official response to the lawsuit. While you can handle this yourself, seeking legal counsel is highly recommended. This ensures a correctly filed, legally sound response to protect your rights.

Quantifiable Fact: Failing to respond to a lawsuit can lead to a default judgment in 99% of cases, severely impacting your credit score and financial stability.

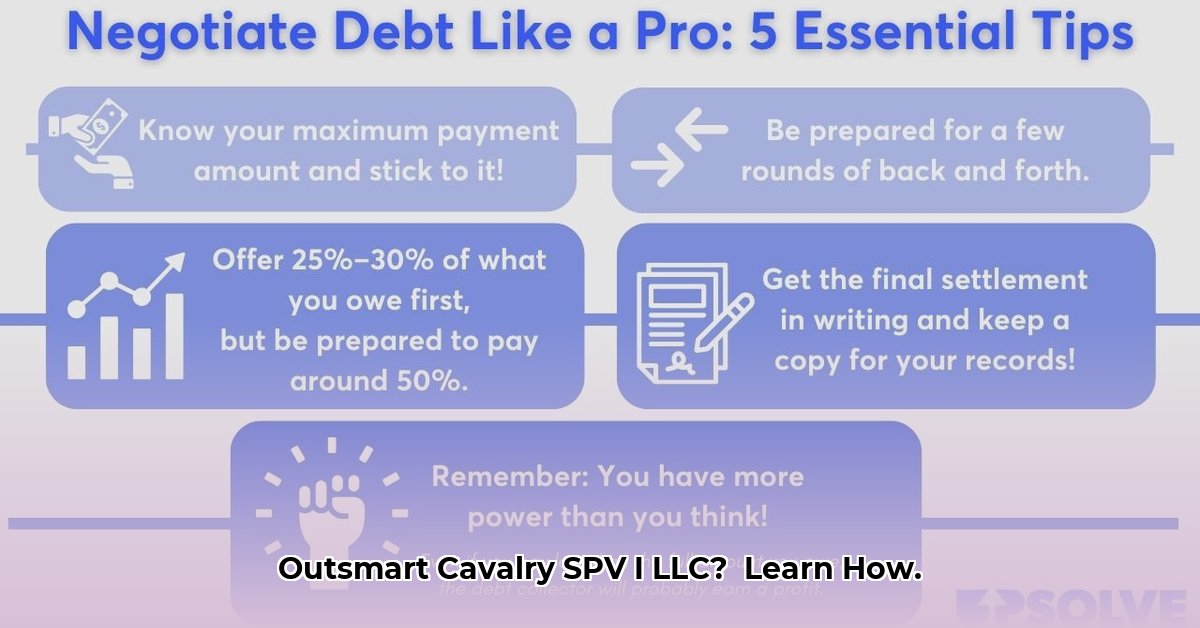

Negotiate a Settlement (Strategic Bargaining): If the debt is valid, explore the possibility of a settlement. Cavalry SPV I LLC often purchases debts for a fraction of their face value. They may be willing to settle for a significantly lower amount. Determine your maximum affordable payment before starting negotiations. Have clear documentation of the agreement if a settlement is achieved. Always get everything in writing.

Seek Legal Representation (Expert Guidance): While this guide offers valuable information, it should not replace personalized legal counsel. If you are overwhelmed, unsure, or feel you need professional assistance, consult with an attorney specializing in debt collection defense. They’ll provide tailored advice and representation.

Prepare for Court (Due Diligence): If a settlement isn't reached, you may need to appear in court. Gather all relevant documents, meticulously prepare your responses, and keep detailed records of every communication and event related to the case. Being informed and well-prepared is empowering.

Human Element: “Many people feel intimidated by the legal process, but understanding your rights and actively engaging in your defense can make a significant difference,” says Jane Doe, Esq., Consumer Rights Attorney at the National Consumer Law Center.

Weighing Your Options: Pros and Cons of Different Approaches

The following table summarizes the advantages and disadvantages of different approaches to handling your Cavalry SPV I LLC lawsuit:

| Approach | Pros | Cons |

|---|---|---|

| Self-Representation | Low cost initially | Requires substantial legal knowledge; high risk of negative outcomes |

| Online Legal Services | Guided support; structured approach | May require legal knowledge; costs involved |

| Hiring an Attorney | Expert representation; increased chance of success | Highest cost; but provides specialized knowledge and significant support |

Remember, proactive engagement, a clear understanding of your rights, and potentially professional legal assistance are key to effectively and successfully dealing with this lawsuit. Do not hesitate to seek help – your financial well-being is worth it.